How Has International Trade Changed Since Ww2

All our charts on Trade and Globalization

Trade has inverse the world economy

Trade has grown remarkably over the last century

The integration of national economies into a global economic system has been one of the most important developments of the last century. This process of integration, oft called Globalization, has materialized in a remarkable growth in merchandise between countries.

The chart hither shows the value of world exports over the menstruation 1800-2014. These estimates are in constant prices (i.e. take been adapted to business relationship for inflation) and are indexed at 1913 values.

This chart shows an extraordinary growth in international trade over the concluding couple of centuries: Exports today are more than than 40 times larger than in 1913.

You tin click on the choice marked 'Linear', on top of the vertical axis, to change into a logarithmic scale. This will aid you encounter that, over the long run, growth has roughly followed an exponential path.

Trade has grown more than proportionately with Gdp

The chart above shows how much more than trade we have today relative to a century agone. But what about merchandise relative to full economic output?

Over the final couple of centuries the world economic system has experienced sustained positive economic growth, so looking at changes in trade relative to GDP offers some other interesting perspective.

The side by side chart plots the value of trade in goods relative to GDP (i.eastward. the value of merchandise trade as a share of global economic output).

Upwards to 1870, the sum of worldwide exports accounted for less than 10% of global output. Today, the value of exported goods effectually the world is close to 25%. This shows that over the terminal hundred years of economic growth, there has been more than proportional growth in global trade.

(NB. In this chart y'all tin can add together countries past choosing the pick on the bottom left; or you lot can compare countries around the world by clicking on 'Map' on the chart.)

Today trade is a fundamental office of economic action everywhere

In today'south global economic system, countries substitution non just final products, but also intermediate inputs. This creates an intricate network of economic interactions that cover the whole earth.

The interactive data visualization, created by the London-based information visualisation studio Kiln and the UCL Free energy Institute, gives us an insight into the circuitous nature of trade. Information technology plots the position of cargo ships across the oceans.

Trade generates efficiency gains

The raw correlation between trade and growth

Over the last couple of centuries the world economy has experienced sustained positive economical growth, and over the same menstruum, this procedure of economical growth has been accompanied by fifty-fifty faster growth in global trade.

In a similar way, if we look at country-level data from the last one-half century we find that at that place is also a correlation between economic growth and trade: countries with higher rates of GDP growth also tend to have college rates of growth in merchandise as a share of output. This bones correlation is shown in the chart here, where we plot average annual change in real GDP per capita, against growth in merchandise (boilerplate annual change in value of exports as a share of GDP).one

Is this statistical clan betwixt economic output and trade causal?

Amidst the potential growth-enhancing factors that may come from greater global economic integration are: Competition (firms that fail to adopt new technologies and cut costs are more likely to fail and to be replaced by more dynamic firms); Economies of scale (firms that can export to the earth confront larger demand, and under the correct weather, they can operate at larger scales where the price per unit of product is lower); Learning and innovation (firms that trade proceeds more experience and exposure to develop and prefer technologies and industry standards from foreign competitors).two

Are these mechanisms supported past the data? Let's have a look at the available empirical evidence.

Causality: Evidence from cantankerous-country differences in trade, growth and productivity

When it comes to academic studies estimating the impact of trade on Gross domestic product growth, the almost cited paper is Frankel and Romer (1999).three

In this study, Frankel and Romer used geography every bit a proxy for merchandise, in order to estimate the bear upon of trade on growth. This is a classic example of the and then-called instrumental variable approach. The thought is that a land's geography is fixed, and mainly affects national income through trade. So if we observe that a state's distance from other countries is a powerful predictor of economic growth (after accounting for other characteristics), then the determination is drawn that it must be because trade has an issue on economic growth. Following this logic, Frankel and Romer observe evidence of a stiff affect of trade on economic growth.

Other papers accept applied the same approach to richer cross-land data, and they have found similar results. A primal instance is Alcalá and Ciccone (2004).4

This body of bear witness suggests trade is indeed ane of the factors driving national average incomes (GDP per capita) and macroeconomic productivity (Gross domestic product per worker) over the long run.v

Causality: Testify from changes in labor productivity at the firm level

If merchandise is causally linked to economic growth, nosotros would expect that trade liberalization episodes also lead to firms becoming more productive in the medium, and even brusque run. There is evidence suggesting this is often the case.

Pavcnik (2002) examined the effects of liberalized merchandise on institute productivity in the example of Chile, during the tardily 1970s and early on 1980s. She found a positive touch on on firm productivity in the import-competing sector. And she also found evidence of aggregate productivity improvements from the reshuffling of resources and output from less to more efficient producers. 6

Bloom, Draca and Van Reenen (2016) examined the impact of rising Chinese import competition on European firms over the menses 1996-2007, and obtained similar results. They found that innovation increased more in those firms most affected by Chinese imports. And they found evidence of efficiency gains through two related channels: innovation increased and new existing technologies were adopted within firms; and amass productivity besides increased because employment was reallocated towards more technologically advanced firms.7

Wrapping upwardly: Trade does generate efficiency gains

On the whole, the available evidence suggests trade liberalization does better economical efficiency. This evidence comes from different political and economical contexts, and includes both micro and macro measures of efficiency.

This result is important, because it shows that there are gains from merchandise. Only of course efficiency is not the only relevant consideration here. Equally we discuss in a companion web log post, the efficiency gains from trade are not generally equally shared by everyone. The prove from the impact of trade on firm productivity confirms this: "reshuffling workers from less to more efficient producers" means closing downwardly some jobs in some places. Because distributional concerns are real it is important to promote public policies – such as unemployment benefits and other safety-net programs – that help redistribute the gains from trade.

The conceptual link between trade and household welfare

When a country opens up to trade, the need and supply of appurtenances and services in the economic system shift. As a consequence, local markets reply, and prices change. This has an impact on households, both as consumers and every bit wage earners.

The implication is that merchandise has an impact on anybody. It'south non the case that the effects are restricted to workers from industries in the trade sector; or to consumers who purchase imported appurtenances. The issue of merchandise extends to everyone because markets are interlinked, so imports and exports have knock-on effects on all prices in the economy, including those in non-traded sectors.

Economists usually distinguish betwixt "full general equilibrium consumption furnishings" (i.due east. changes in consumption that arise from the fact that trade affects the prices of non-traded goods relative to traded goods) and "general equilibrium income effects" (i.e. changes in wages that arise from the fact that trade has an touch on on the demand for specific types of workers, who could be employed in both the traded and not-traded sectors).

Considering all these complex interrelations, information technology's not surprising that economic theories predict that non everyone will benefit from international trade in the aforementioned style. The distribution of the gains from trade depends on what dissimilar groups of people consume, and which types of jobs they take, or could have.

(NB. Yous can read more about these economic concepts, and the related predictions from economic theory, in Chapter eighteen of the textbook The Economy: Economics for a Changing World.)

The link between trade, jobs and wages

Testify from Chinese imports and their affect on factory workers in the US

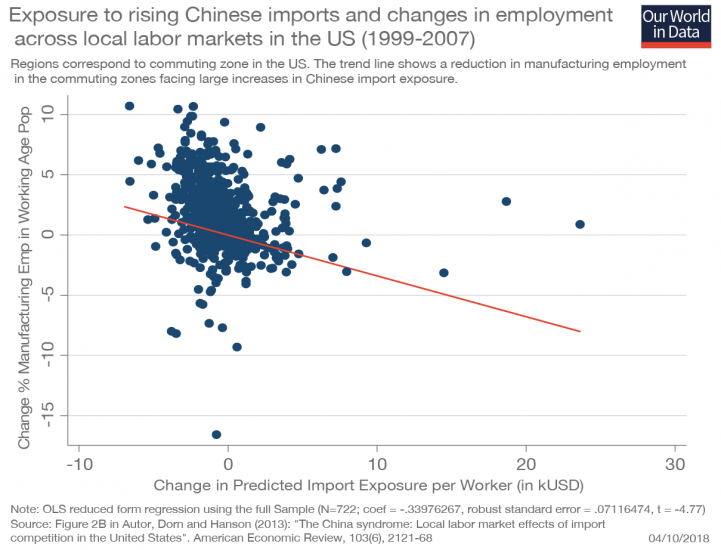

The most famous study looking at this question is Autor, Dorn and Hanson (2013): "The China syndrome: Local labor market effects important competition in the United States".8

In this paper, Autor and coauthors looked at how local labor markets changed in the parts of the country most exposed to Chinese competition, and they establish that rising exposure increased unemployment, lowered labor force participation, and reduced wages. Additionally, they institute that claims for unemployment and healthcare benefits too increased in more trade-exposed labor markets.

The visualization hither is i of the key charts from their paper. It'southward a scatter plot of cantankerous-regional exposure to ascension imports, against changes in employment. Each dot is a pocket-size region (a 'commuting zone' to be precise). The vertical position of the dots represents the percent change in manufacturing employment for working age population; and the horizontal position represents the predicted exposure to rise imports (exposure varies across regions depending on the local weight of different industries).

The trend line in this nautical chart shows a negative human relationship: more than exposure goes together with less employment. There are big deviations from the trend (there are some low-exposure regions with large negative changes in employment); but the paper provides more sophisticated regressions and robustness checks, and finds that this human relationship is statistically significant.

This outcome is important considering it shows that the labor market adjustments were large. Many workers and communities were affected over a long period of time.9

But information technology'due south besides important to keep in mind that Autor and colleagues are only giving us a partial perspective on the full issue of merchandise on employment. In particular, comparing changes in employment at the regional level misses the fact that firms operate in multiple regions and industries at the aforementioned time. Indeed, Ildikó Magyari recently plant evidence suggesting the Chinese trade shock provided incentives for US firms to diversify and reorganize production.x

Then companies that outsourced jobs to China frequently ended up closing some lines of business, only at the aforementioned fourth dimension expanded other lines elsewhere in the US. This means that chore losses in some regions subsidized new jobs in other parts of the country.

On the whole, Magyari finds that although Chinese imports may have reduced employment within some establishments, these losses were more than than offset by gains in employment within the same firms in other places. This is no consolation to people who lost their chore. But it is necessary to add this perspective to the simplistic story of "trade with China is bad for United states workers".

Exposure to rising Chinese imports and changes in employment beyond local labor markets in the US (1999-2007) – Autor, Dorn and Hanson (2013)

Evidence from the expansion of trade in India and the touch on on poverty reductions

Some other important newspaper in this field is Topalova (2010): "Gene immobility and regional impacts of merchandise liberalization: Show on poverty from India".xi

In this paper Topalova looks at the touch on of trade liberalization on poverty beyond different regions in India, using the sudden and extensive change in India's trade policy in 1991. She finds that rural regions that were more exposed to liberalization, experienced a slower decline in poverty, and had lower consumption growth.

In the analysis of the mechanisms underlying this effect, Topalova finds that liberalization had a stronger negative touch amid the to the lowest degree geographically mobile at the bottom of the income distribution, and in places where labor laws deterred workers from reallocating beyond sectors.

The evidence from India shows that (i) discussions that only look at "winners" in poor countries and "losers" in rich countries miss the point that the gains from merchandise are unequally distributed inside both sets of countries; and (ii) context-specific factors, like worker mobility across sectors and geographic regions, are crucial to sympathize the impact of merchandise on incomes.

Evidence from other studies

- Donaldson (2018) uses archival data from colonial India to approximate the touch on of Bharat'due south vast railroad network. He finds railroads increased trade, and in doing so they increased real incomes (and reduced income volatility).12

- Porto (2006) looks at the distributional effects of Mercosur on Argentine families, and finds this regional trade understanding led to benefits beyond the entire income distribution. He finds the effect was progressive: poor households gained more than than eye-income households, because prior to the reform, trade protection benefitted the rich disproportionately.xiii

- Trefler (2004) looks at the Canada-Usa Free Trade Understanding and finds there was a group who bore "adjustment costs" (displaced workers and struggling plants) and a group who enjoyed "long-run gains" (consumers and efficient plants). xiv

The link betwixt trade and the toll of living

The fact that trade negatively affects labor market opportunities for specific groups of people does not necessarily imply that trade has a negative aggregate outcome on household welfare. This is because, while trade affects wages and employment, it likewise affects the prices of consumption goods. And so households are affected both as consumers and as wage earners.

Virtually studies focus on the earnings aqueduct, and effort to approximate the touch of trade on welfare by looking at how much wages can buy, using as reference the irresolute prices of a fixed basket of goods.

This approach is problematic because it fails to consider welfare gains from increased product variety, and obscures complicated distributional bug such equally the fact that poor and rich individuals swallow unlike baskets so they do good differently from changes in relative prices.15

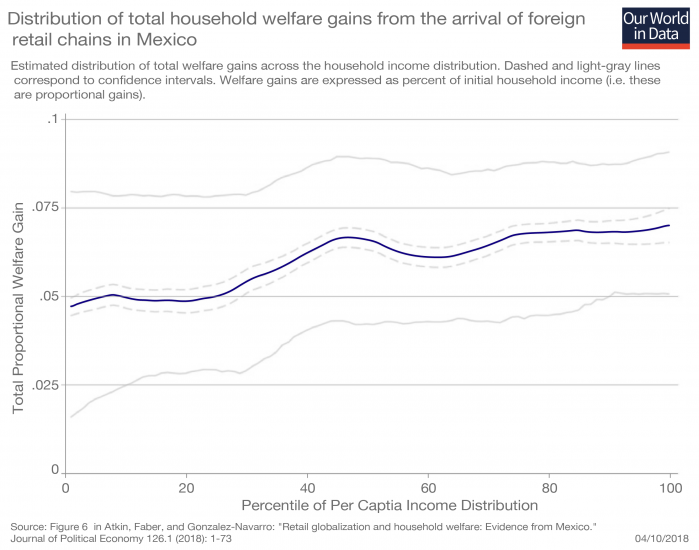

Ideally, studies looking at the affect of merchandise on household welfare should rely on fine-grained information on prices, consumption and earnings. This is the arroyo followed in Atkin, Faber, and Gonzalez-Navarro (2018): "Retail globalization and household welfare: Evidence from Mexico".16

Atkin and coauthors use a uniquely rich dataset from Mexico, and observe that the arrival of global retail chains led to reductions in the incomes of traditional retail sector workers, simply had lilliputian affect on boilerplate municipality-level incomes or employment; and led to lower costs of living for both rich and poor households.

The nautical chart here shows the estimated distribution of full welfare gains across the household income distribution (the light-greyness lines correspond to confidence intervals). These are proportional gains, and are expressed as percent of initial household income.

As nosotros tin can see, there is a net positive welfare effect across all income groups; but these improvements in welfare are regressive, in the sense that richer households gain proportionally more (about 7.5 percentage gain compared to v per centum).17

Evidence from other countries confirms this is not an isolated case – the expenditure aqueduct really seems to be an important and understudied source of household welfare. Giuseppe Berlingieri, Holger Breinlich, Swati Dhingra, for instance, investigate the consumer benefits from trade agreements implemented past the EU between 1993 and 2013; and they observe that these merchandise agreements increased the quality of bachelor products, which translated into a cumulative reduction in consumer prices equivalent to savings of €24 billion per year for EU consumers.xviii

Distribution of total household welfare gains from the arrival of foreign retail bondage in Mexico – Atkin, Faber, and Gonzalez-Navarro (2018)

Wrapping up: Net welfare effects and implications

The available evidence shows that, for some groups of people, trade has a negative event on wages and employment opportunities; and at the same time it has a big positive upshot via lower consumer prices and increased availability of products.

Two points are worth emphasising.

For some households, the net effect is positive. Only for some households that'southward not the case. In item, workers who lose their job can be affected for extended periods of fourth dimension, and then the positive effect via lower prices is not plenty to compensate them for the reduction in earnings.

On the whole, if we amass changes in welfare across households, the internet outcome is usually positive. But this is hardly a consolation for those who are worse off.

This highlights a complex reality: There are aggregate gains from merchandise, merely in that location are also existent distributional concerns. Even if merchandise is not a major commuter of income inequalities, it'due south important to keep in heed that public policies, such equally unemployment benefits and other safety-internet programs, tin and should aid redistribute the gains from merchandise.

The "two waves of globalization"

The first "moving ridge of globalization" started in the 19th century, the second one after WW2

The following visualization presents a compilation of available trade estimates, showing the development of globe exports and imports every bit a share of global economical output.

This metric (the ratio of total merchandise, exports plus imports, to global GDP) is known equally the 'openness index'. The higher the alphabetize, the higher the influence of trade transactions on global economic activeness.19

Every bit we can see, until 1800 there was a long flow characterized by persistently low international merchandise – globally the index never exceeded x% before 1800. This and then changed over the course of the 19th century, when technological advances triggered a flow of marked growth in world merchandise – the so-called 'commencement moving ridge of globalization'.

The showtime wave of globalization came to an stop with the offset of the First World State of war, when the decline of liberalism and the rise of nationalism led to a slump in international trade. In the chart we see a large driblet in the interwar menses.

Subsequently the 2d World War trade started growing over again. This new – and ongoing – moving ridge of globalization has seen international merchandise grow faster than always before. Today the sum of exports and imports across nations amounts to more than 50% of the value of total global output.

(NB. Klasing and Milionis (2014), which is one of the sources in the chart, published an additional set of estimates under an alternative specification. Similarly, for the flow 1960-2015, the World Bank's World Development Indicators published an alternative set of estimates, which are like but not identical to those included from the Penn World Tables (9.1). You find all these culling overlapping sources in this comparison chart.)

Earlier the first wave of globalization, trade was driven mostly by colonialism

Over the early modern period, transoceanic flows of appurtenances betwixt empires and colonies deemed for an important function of international trade. The following visualizations provides a comparison of intercontinental trade, in per capita terms, for different countries.

As nosotros can see, intercontinental trade was very dynamic, with volumes varying considerably across time and from empire to empire.

Leonor Freire Costa, Nuno Palma, and Jaime Reis, who compiled and published the original data shown here, argue that merchandise, too in this menses, had a substantial positive bear on on the economic system.twenty

The get-go moving ridge of globalization was marked by the rise and collapse of intra-European trade

The following visualization shows a detailed overview of Western European exports past destination. Figures stand for to export-to-Gdp ratios (i.eastward. the sum of the value of exports from all Western European countries, divided by full Gdp in this region). Using the choice labeled 'relative', at the bottom of the chart, you can meet the proportional contribution of each region to total Western European exports.

This nautical chart shows that growth in Western European merchandise throughout the 19th century was largely driven by trade within the region: In the period 1830-1900 intra-European exports went from 1% of GDP to 10% of GDP; and this meant that the relative weight of intra-European exports doubled over the period (in the 'relative' view you can see the irresolute limerick of exports past destination, and you can bank check that the weight of intra-European merchandise went from nearly one third to about 2 thirds over the catamenia). Only this process of European integration then collapsed sharply in the interwar period.

After the 2d Earth War trade within Europe rebounded, and from the 1990s onwards exceeded the highest levels of the first wave of globalization. In improver Western Europe then started to increasingly trade with Asia, the Americas, and to a smaller extent Africa and Oceania.

The next graph, from Broadberry and O'Rourke (2010)21, shows another perspective on the integration of the global economy and plots the development of three indicators measuring integration beyond different markets – specifically goods, labor, and capital markets.

The indicators in this chart are indexed, and then they prove changes relative to the levels of integration observed in 1900. This gives us another viewpoint to understand how quickly global integration collapsed with the two Earth Wars.

(NB. Integration in the goods markets is measured hither through the 'trade openness index', which is defined by the sum of exports and imports every bit share of Gross domestic product. In this interactive chart you can explore trends in merchandise openness over this period for a selection of European countries.)

The second wave of globalization was enabled by technology

The earth-wide expansion of trade subsequently the Second World War was largely possible considering of reductions in transaction costs stemming from technological advances, such as the development of commercial ceremonious aviation, the improvement of productivity in the merchant marines, and the democratization of the telephone as the main mode of advice. The visualization shows how, at the global level, costs beyond these three variables have been going downwardly since 1930.

The reductions in transaction costs had an impact, non only on the volumes of trade, but also on the types of exchanges that were possible and profitable.

The beginning wave of globalization was characterized by inter-manufacture trade. This means that countries exported goods that were very different to what they imported – England exchanged machines for Australian wool and Indian tea. As transaction costs went down, this changed. In the second wave of globalization we are seeing a rise in intra-industry trade (i.eastward. the exchange of broadly like goods and services is becoming more and more than common). France, for case, now both imports and exports machines to and from Federal republic of germany.

The following visualization, from the UN Globe Development Report (2009), plots the fraction of full world merchandise that is deemed for past intra-manufacture merchandise, by type of goods. As nosotros tin can come across, intra-manufacture trade has been going up for primary, intermediate and final goods.

This blueprint of merchandise is of import because the scope for specialization increases if countries are able to exchange intermediate goods (eastward.g. auto parts) for related final appurtenances (east.g. cars).

Two centuries of trade, country by land

Above we took a look at the broad global trends over the concluding two centuries. Let's now zoom in on country-level trends over this long and dynamic period.

This nautical chart plots estimates of the value of trade in appurtenances, relative to total economic activity (i.east. export-to-GDP ratios).

These historical estimates plainly come with a large margin of mistake (in the measurement section below we discuss the data limitations); yet they offer an interesting perspective.

You can add more series by clicking on the option ' Add country '. Each country tells a unlike story. If you add the Netherlands, for case, you will see how important the Dutch Golden Historic period was.

(NB. Here is the same chart but showing imports, rather than exports.)

Changing trade partners

In the next chart nosotros plot, country past land, the regional breakup of exports. India is shown past default, but you lot can switch country using the option 'Alter entity'.

Using the option 'relative', at the lesser of the nautical chart, you can come across the proportional contribution of purchases from each region. For example: We come across that 48% of the total value of Indian exports in 2014 went to Asian countries.

This gives u.s. an interesting perspective on the changing nature of merchandise partnerships. In India, we see the rising importance of merchandise with Africa – this is a pattern that we discuss in more detail beneath.

How much do countries merchandise?

Trade openness effectually the world

The so-called trade openness index is an economic metric calculated as the ratio of country'south total trade (the sum of exports plus imports) to the country's gross domestic product.

This metric gives us an idea of integration, considering it captures all incoming and outgoing transactions. The college the index the larger the influence of trade on domestic economical activities.

The visualization presents a world map showing the trade openness index country by country. You tin can explore country-specific time series by clicking on a country, or by using the 'Nautical chart' tab.

For any given year, we see that there is a lot of variation across countries. The weight of trade in the The states economic system, for instance, is much lower than in other rich countries.

If you printing the play button in the map, you tin see changes over fourth dimension. This reveals that, despite the great variation between countries, there is a common trend: Over the last couple of decades trade openness has gone up in virtually countries.

Exports and imports in existent dollars

Expressing trade values as a share of Gdp tells the states the importance of trade in relation to the size of economic activity. Allow's now take a look at merchandise in monetary terms – this tells us the importance of merchandise in absolute, rather than relative terms.

The nautical chart shows the value of exports (goods plus services) in dollars, country by land. All estimates are expressed in abiding 2010 dollars (i.east. all values accept been adjusted to correct for inflation).

The main takeaway here are the country-specific trends, which are positive and more than pronounced than in the charts showing shares of GDP. This is not surprising: well-nigh countries today produce more a couple of decades agone; and at the same time they merchandise more than of what they produce.

Y'all can plot trends by region using the option ' Add land '.

(NB. Here is the same nautical chart, just showing imports rather than exports.)

What do countries trade?

Trade in appurtenances vs Trade in services

Trade transactions include appurtenances (tangible products that are physically shipped across borders by road, rails, h2o, or air) and services (intangible commodities, such as tourism, financial services, and legal advice).

Many traded services make merchandise trade easier or cheaper—for example, shipping services, or insurance and financial services.

Merchandise in goods has been happening for millenia; while merchandise in services is a relatively recent miracle.

In some countries services are today an important driver of trade: In the United kingdom services account for virtually 45% of all exports; and in the Bahama islands nearly all exports are services (nigh 87% in 2016).

In other countries the opposite is truthful: In Nigeria and Venezuela services deemed for around 2% and three% of exports, respectively, in 2014.

Globally, merchandise in appurtenances accounts for the bulk of trade transactions. But equally this chart shows, the share of services in total global exports has increased, from 17% in 1979 to 24% in 2017.

(NB. This interactive chart shows trade in services every bit share of Gdp beyond countries and regions.)

Domestic vs Strange value added in exports

Firms around the world import goods and services, in order to employ them as inputs to produce goods and services that are afterwards exported. The imported goods and services incorporated in a country's exports are a key indicator of economic integration – they tell us something about 'global value bondage', where the unlike stages of the production process are located beyond dissimilar countries.

The chart, from UNCTAD's Earth Investment Study 2018 – Investment and New Industrial Policies, shows trends of gross exports, cleaved down into domestic and foreign value added. That is, the share of the value of exports that comes from foreign inputs.

Today, about 30% of the value of global exports comes from foreign inputs. In 1990, the share was virtually 25%.

Foreign value added in merchandise peaked in 2010–2012 after ii decades of continuous increment. This is consequent with the fact that, afterwards the global fiscal crunch, in that location has been a slowdown in the rate of growth of trade in appurtenances and services, relative to global Gdp. This is a sign that global integration stalled afterward the financial crisis.

(NB. The integration of global value chains is a common source of measurement error in trade information, because it makes it difficult to correctly attribute the origin and destination of goods and services. We discuss this in more detail below.)

How are trade partnerships changing?

Bilateral trade is becoming increasingly common

If we consider all pairs of countries that appoint in merchandise around the world, nosotros observe that in the majority of cases, at that place is a bilateral relationship today: About countries that export goods to a land, too import appurtenances from the same land.

The interactive visualization shows this.23

In this chart, all possible land pairs are partitioned into three categories: the top portion represents the fraction of country pairs that do non merchandise with 1-some other; the middle portion represents those that trade in both directions (they export to one-some other); and the bottom portion represents those that trade in one direction only (1 country imports from, but does not consign to, the other country).

Equally we tin see, bilateral trade is becoming increasingly mutual (the middle portion has grown substantially). But it remains true that many countries still do not trade with each other at all (in 2014 about 25% of all land-pairs recorded no trade).

S-South trade is becoming increasingly important

The visualization here shows the share of earth merchandise trade that corresponds to exchanges between today's rich countries and the residue of the world.

The 'rich countries' in this chart are: Australia, Austria, Kingdom of belgium, Canada, Cyprus, Denmark, Finland, French republic, Frg, Greece, Iceland, Ireland, Israel, Italy, Japan, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom and the U.s.a.. 'Not-rich countries' are all the other countries in the world.

As we can see, up until the Second World War the bulk of trade transactions involved exchanges betwixt this small grouping of rich countries. But this has been changing quickly over the last couple of decades, and today trade between not-rich countries is only as important as trade between rich countries.

In the past 2 decades China has been a fundamental driver of this dynamic: the UN Man Development Report (2013) estimates that between 1992 and 2011, China's merchandise with Sub-Saharan Africa rose from $one billion to more than $140 billion.

(NB. Here is a stacked area chart showing the total limerick of exports by partnership. It's the same data, but plotted with stacked serial.)

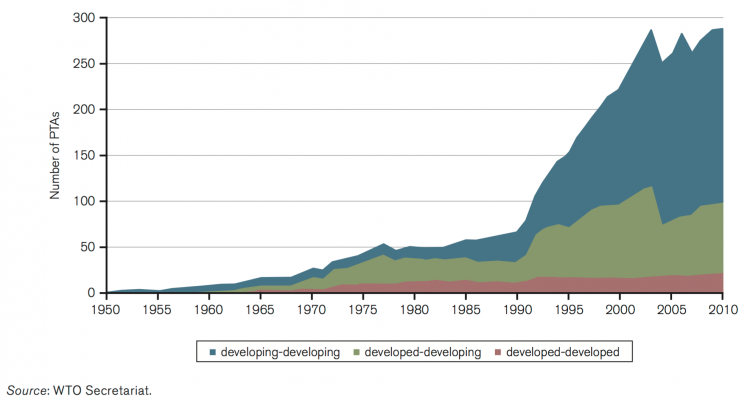

The majority of preferential trade agreements are between emerging economies

The last few decades have non only seen an increase in the book of international merchandise, but also an increase in the number of preferential trade agreements through which exchanges take identify. A preferential trade agreement is a trade pact that reduces tariffs betwixt the participating countries for sure products.

The visualization here shows the evolution of the cumulative number of preferential trade agreements that are in force beyond the world, according to the World Trade Organization (WTO). These numbers include notified and non-notified preferential agreements (the source reports that only nearly 2-thirds of the agreements currently in force have been notified to the WTO), and are disaggregated by country groups.

This figure shows the increasingly of import role of trade betwixt developing countries (South-South trade), vis-a-vis trade between adult and developing countries (North-South merchandise). In the late 1970s, Northward-Due south agreements accounted for more than than half of all agreements – in 2010, they accounted for nigh i quarter. Today, the majority of preferential merchandise agreements are betwixt developing economies.

Number of preferential trade agreements in forcefulness by country group, 1950-2010 – Figure B1 in WTO Trade Written report (2011)

Trading patterns have been changing speedily in heart income countries

The increment in merchandise among emerging economies over the last half century has been accompanied by an important modify in the composition of exported goods in these countries.

The side by side visualization plots the share of nutrient exports in each state'south full exported merchandise. These figures, produced by the World Depository financial institution, correspond to the Standard International Trade Classification, in which 'food' includes, among other appurtenances, alive animals, beverages, tobacco, coffee, oils, and fats.

Two points stand out. Commencement, there has been a substantial decrease in the relative importance of food exports since 1960s in most countries (although globally in the last decade it has gone upward slightly). And 2d, this subtract has been largest in center income countries, peculiarly in Latin America. Republic of colombia is a notable case in indicate: food went from 77% of merchandise exports in 1962, to xv.9% in 2015.

Regarding levels, as one would expect, in high income countries nutrient still accounts for a much smaller share of merchandise exports than in most low- and heart-income-countries.

Explaining trade patterns: Theory and Testify

- Comparative advantage

- Trade diminishes with altitude

- Institutions

- Increasing returns to scale

Comparative reward

Theory: What is 'comparative advantage' and why does it matter to understand trade?

In economic theory, the 'economic toll' – or the 'opportunity cost' – of producing a skilful is the value of everything you need to surrender in lodge to produce that good.

Economic costs include physical inputs (the value of the stuff you apply to produce the good), plus forgone opportunities (when y'all allocate scarce resources to a job, you give up alternative uses of those resources).

A country or a person is said to have a 'comparative reward' if they have the ability to produce something at a lower opportunity price than their trade partners.

The forgone opportunities of production are central to understand this concept. Information technology is precisely this that distinguishes absolute advantage from comparative advantage.

To see the departure between comparative and absolute advantage, consider a commercial aviation pilot and a baker. Suppose the pilot is an first-class chef, and she can bake merely too, or even ameliorate than the bakery. In this example, the pilot has an absolute advantage in both tasks. Yet the bakery probably has a comparative reward in baking, because the opportunity cost of baking is much higher for the pilot.

The freely available economics textbook The Economy: Economics for a Changing Earth explains this as follows: "A person or state has comparative advantage in the production of a item good, if the toll of producing an additional unit of that practiced relative to the toll of producing some other skillful is lower than another person or land's cost to produce the aforementioned 2 goods."

At the individual level, comparative advantage explains why you might want to delegate tasks to someone else, even if y'all tin can do those tasks amend and faster than them. This may audio counterintuitive, just it is not: If you are good at many things, it means that investing time in one task has a high opportunity cost, because you are not doing the other amazing things yous could be doing with your time and resources. So, at least from an efficiency indicate of view, you should specialize on what you are best at, and consul the rest.

The same logic applies to countries. Broadly speaking, the principle of comparative reward postulates that all nations can gain from trade if each specializes in producing what they are relatively more than efficient at producing, and import the rest: "do what you do all-time, import the rest".24

In countries with relative affluence of certain factors of production, the theory of comparative advantage predicts that they will consign goods that rely heavily in those factors: a country typically has a comparative reward in those goods that use more than intensively its abundant resources. Colombia exports bananas to Europe considering information technology has comparatively abundant tropical weather. Under autarky, Colombia would detect information technology inexpensive to produce bananas relative to due east.g. apples.

Evidence: Is there empirical back up for comparative-advantage theories of trade?

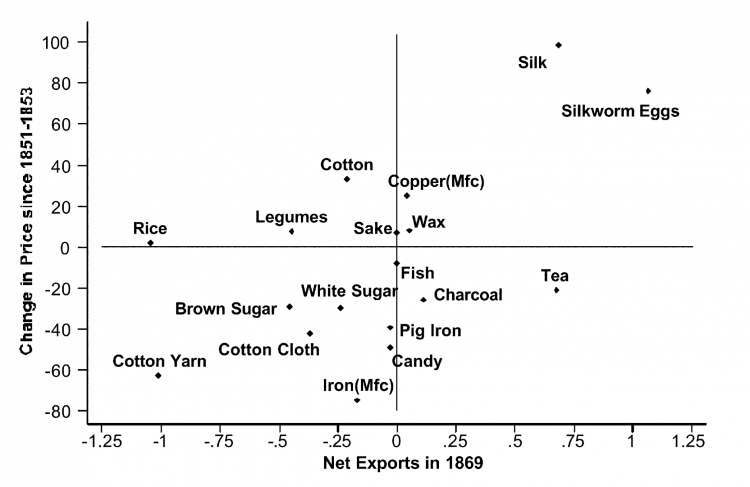

The empirical prove suggests that the principle of comparative reward does help explain trade patterns. Bernhofen and Brown (2004)25, for case, provide evidence using the experience of Japan. Specifically, they exploit Nippon's dramatic nineteenth-century move from a state of near complete isolation to broad trade openness.

The graph here shows the price changes of the fundamental tradable appurtenances subsequently the opening up to trade. It presents a besprinkle diagram of the internet exports in 1869 graphed in relation to the change in prices from 1851–53 to 1869. As we can see, this is consistent with the theory: afterwards opening to trade, the relative prices of major exports such as silk increased (Japan exported what was cheap for them to produce and which was valuable away), while the relative price of imports such as sugar declined (they imported what was relatively more difficult for them to produce, but was cheap abroad).

Net exports and price changes for 1869, Japan – Figure 4 in Bernhofen and Brownish (2014)26

Trade diminishes with altitude

The resistance that geography imposes on merchandise has long been studied in the empirical economics literature – and the main conclusion is that trade intensity is strongly linked to geographic distance.

The visualization, from Eaton and Kortum (2002)27, graphs 'normalized import shares' confronting distance. Each dot represents a state-pair from a ready of nineteen OECD countries, and both the vertical and horizontal axis are expressed on logarithmic scales.

The 'normalized import shares' in the vertical centrality provide a measure out of how much each country imports from different partners (see the paper for details on how this is calculated and normalised), while distance in the horizontal axis corresponds to the distance between central cities in each state (encounter the newspaper and references therein for details on the listing of cities). Equally we can encounter, there is a strong negative human relationship. Trade diminishes with distance. Through econometric modeling, the newspaper shows that this relationship is not just a correlation driven by other factors: their findings suggest that distance imposes a significant barrier to trade.

The fact that merchandise diminishes with distance is besides corroborated by data of trade intensity within countries. The visualization here shows, through a series of maps, the geographic distribution of French firms that export to French republic'southward neighboring countries. The colors reverberate the per centum of firms which consign to each specific land. As we can see, the share of firms exporting to each of the corresponding neighbors is largest close to the border. The authors also show in the paper that this pattern holds for the value of individual-house exports – merchandise value decreases with distance to the border.

Institutions

Conducting international trade requires both fiscal and non-financial institutions to support transactions. Some of these institutions are fairly obvious (e.g. constabulary enforcement); only some are less obvious. For example, the evidence shows that producers in exporting countries frequently need credit in order to engage in trade.

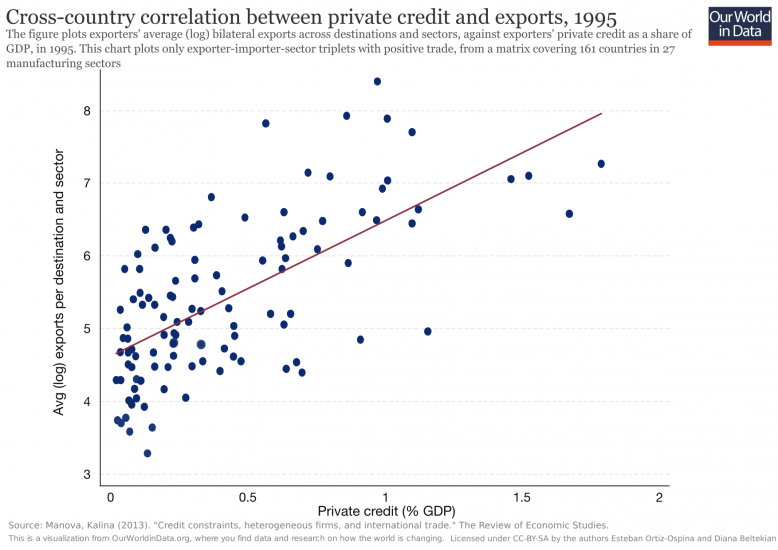

The scatter plot, from Manova (2013)30, shows the correlation betwixt levels in private credit (specifically exporters' individual credit as a share of Gross domestic product) and exports (average log bilateral exports across destinations and sectors). As can be seen, financially adult economies – those with more than dynamic individual credit markets – typically outperform exporters with less evolved fiscal institutions.

Other studies accept shown that country-specific institutions, like the noesis of foreign languages, for instance, are too of import to promote strange relative to domestic trade (encounter Melitz 200831).

Cantankerous-land correlation between private credit and exports – Effigy two in Manova (2013)32

Increasing returns to calibration

The concept of comparative advantage predicts that if all countries had identical endowments and institutions, then there would be fiddling incentives for specialization, because the opportunity cost of producing whatever adept would be the same in every land.

So you may wonder: why is it then the case that in the last few years we have seen such rapid growth in intra-manufacture merchandise betwixt rich countries?

The increase in intra-industry betwixt rich countries seems paradoxical under the lite of comparative advantage, considering in contempo decades we have seen convergence in key factors, such as human capital letter, beyond these countries.

The solution to the paradox is actually non very complicated: Comparative advantage is 1, only not the only force driving incentives to specialization and trade.

Several economists, most notably Paul Krugman, have developed theories of trade in which merchandise is non due to differences betwixt countries, but instead due to "increasing returns to calibration" – an economic term used to denote a engineering in which producing extra units of a proficient becomes cheaper if you operate at a larger calibration.

The idea is that specialization allows countries to reap greater economies of calibration (i.eastward. to reduce production costs by focusing on producing big quantities of specific products), so trade tin exist a proficient idea fifty-fifty if the countries do not differ in endowments, including culture and institutions.

These models of merchandise, often referred to every bit 'New Trade Theory', are helpful to explain why in the last few years nosotros have seen such rapid growth in two-way exchanges of goods within industries betwixt developed nations.

In a much cited newspaper, Evenett and Keller (2002)33 show that both factor endowments and increasing returns assistance explain production and trade patterns around the world.

You lot can learn more about New Merchandise Theory, and the empirical support behind information technology, in Krugman's Nobel lecture.

There are dozens of official sources of information on international merchandise, and if you compare these different sources, you will observe that they do not concord with ane another. Even if you lot focus on what seems to exist the same indicator for the same twelvemonth in the same country, discrepancies are large.

For example, for Red china in 2010, the estimated total value of goods exports was $1.48 trillion according to Earth Banking company Data, but it was $1.58 trillion according to WTO Data. That's a difference of about seven%, or a hundred billion US dollars.

Such differences between sources tin can besides exist found for rich countries where statistical agencies tend to follow international reporting guidelines more closely. In Italian republic, for example, Eurostat figures of the value of exported goods in 2015 are 10% higher than the merchandise merchandise figures published past the OECD.

And there are as well large bilateral discrepancies within sources. According to Imf information, for instance, the value of appurtenances that Canada reports exporting to the US is almost $xx billion more that the value of appurtenances that the US reports importing from Canada.

Here we explicate how international trade information is collected and processed, and why there are such large discrepancies.

What data is available?

How large are discrepancies between sources?

In the visualization hither we provide a comparison of the data published by several of the sources listed above, country by country, since 1955 up until today.

For each country, we exclude trade in services, and nosotros focus simply on estimates of the total value of exported goods, expressed every bit shares of GDP.37

As we can conspicuously see in this chart, different information sources tell often very different stories. And this is truthful, to varying degrees, across all countries and years. Yous can use the selection labeled 'change country', at the bottom of the chart, to focus on any land.

Constructing this chart was demanding. It required downloading trade information from many different sources, collecting the relevant series, and and then standardising them and then that the units of measure and the geographical territories were consequent.

All serial, except the two long-run serial from CEPII and NBER-UN, were produced from data published past the sources in current US dollars, and and so converted to Gross domestic product shares using a unique source (Globe Bank).38

So, if all serial are in the same units (share of national GDP), and they all measure the same thing (value of goods exported from one country to the residuum of the world), what explains the differences?

Allow's dig deeper to sympathise what'south going on.

Why doesn't the data add up?

Differences in guidelines used by countries to record and report merchandise information

Broadly speaking, there are two main approaches used to estimate international merchandise trade:

- The commencement approach relies on estimating trade from customs records, often complementing or correcting figures with data from enterprise surveys and administrative records associated with tax. The main transmission providing guidelines for this approach is the International Merchandise Trade Statistics Manual (IMTS).

- The 2d approach relies on estimating merchandise from macroeconomic data, typically National Accounts. The main manual providing guidelines for this approach is the Balance of Payments and International Investment Position Transmission (BPM6), which was drafted in parallel with the 2008 System of National Accounts of the United nations (SNA 2008). The idea behind this arroyo is recording changes in economic ownership.39

Under these two approaches, information technology is common to distinguish between 'traded merchandise' and 'traded goods'. The stardom is often made because goods only being transported through a country (i.e. goods in transit) are not considered to change the stock of material resources of a state, and are hence often excluded from the more narrow concept of 'merchandise trade'.

Likewise, adding to the complication, countries frequently rely on measurement protocols that are adult alongside these approaches and concepts that are not perfectly compatible to begin with. In Europe, for instance, countries use the 'Compilers guide on European statistics on international trade in appurtenances'.

Measurement error and other inconsistencies

Fifty-fifty when two sources rely on the aforementioned wide accounting approach, discrepancies ascend because countries fail to adhere perfectly to the protocols.

In theory, for case, the exports of land A to state B should mirror the imports of country B from country A. Only in do this is rarely the case because of differences in valuation. According to the BPM6, imports and exports should exist recorded in the balance of payments accounts on a 'free on board (Play a joke on) basis', which means using prices that include all charges up to placing the goods on board a ship at the port of departure. Nevertheless many countries stick to Play a trick on values only for exports, and utilise CIF values for imports (CIF stands for 'Toll, Insurance and Freight', and includes the costs of transportation).40

The chart here gives yous an idea of how big import-export asymmetries are. Shown are the differences betwixt the value of goods that each land reports exporting to the US, and the value of goods that the US reports importing from the same countries. For example, for China, the figure in the chart corresponds to the "Value of merchandise imports in the U.s. from Communist china" minus "Value of merchandise exports from Mainland china to the US".

The differences in the chart here, which are both positive and negative, suggest that there is more going on than differences in FOB vs CIF values. If all asymmetries were coming from CIF-FOB differences, then nosotros should only see positive values in the chart (remember that, unlike Flim-flam values, CIF values include the cost of transportation, so CIF values are larger).

What else is going on hither?

Some other mutual source of measurement error relates to the inconsistent attribution of trade partners. An example is failure to follow the guidelines on how to treat goods passing through intermediary countries for processing or merchanting purposes. Every bit global production bondage become more than complex, countries find it increasingly difficult to unambiguously establish the origin and terminal destination of merchandise, even when rules are established in the manuals. 41

And there are still more potential sources of discrepancies. For case differences in customs and revenue enhancement regimes, and differences betwixt "general" and "special" trade systems (i.eastward. differences between statistical territories and bodily country borders, which practise not often coincide because of things like 'custom gratis zones').42

Even when ii sources have identical trade estimates, inconsistencies in published information can ascend from differences in exchange rates. If a dataset reports cross-country trade information in United states dollars, estimates will vary depending on the exchange rates used. Unlike exchange rates will lead to conflicting estimates, even if figures in local currency units are consistent.

Wrapping up

Asymmetries in international trade statistics are large and they arise for a variety of reasons. These include conceptual inconsistencies across measurement standards, every bit well as inconsistencies in the way countries employ agreed protocols. Here's a checklist of issues to proceed in mind when comparing sources.

- Differences in underlying records: is trade measured from National Accounts data rather than straight from custom or taxation records?

- Differences in import and export valuations: are transactions valued at Fox or CIF prices?

- Inconsistent attribution of trade partners: how is the origin and final destination of merchandise established?

- Difference between 'goods' and 'trade': how are re-importing, re-exporting, and intermediary merchanting transactions recorded?

- Exchange rates: how are values converted from local currency units to the currency that allows international comparisons (about oftentimes the United states-$)?

- Differences betwixt 'general' and 'special' trade system: how is trade recorded for custom-gratis zones?

- Other bug: Fourth dimension of recording, confidentiality policies, product classification, deliberate misinvoicing for illicit purposes.

These factors have long been recognized by many organizations producing trade information. Indeed, international organizations often incorporate corrections, in an try to amend data quality along these lines.

The OECD's Counterbalanced International Merchandise Trade Statistics, for case, uses its ain approach to right and reconcile international merchandise trade statistics.43

The corrections applied in the OECD's 'balanced' serial make this the best source for cross-land comparisons. Even so, this dataset has low coverage across countries, and information technology only goes back to 2011. This is an important obstacle, since the circuitous adjustments introduced by the OECD imply we tin't easily improve coverage by appending data from other sources. At Our World in Data nosotros have called to rely on CEPII as the main source for exploring long-run changes in international trade; simply we as well rely on World Bank and OECD data for up-to-date cross-land comparisons.

In that location are 2 key lessons from all of this. The showtime lesson is that, for near users of merchandise information out there, in that location is no obvious way of choosing between sources. And the second lesson is that, because of statistical glitches, researchers and policymakers should always have assay of trade data with a pinch of salt. For case, in a recent high-contour report, researchers attributed mismatches in bilateral trade data to illicit financial flows through trade misinvoicing (or trade-based money laundering). As nosotros testify here, this interpretation of the data is non appropriate, since mismatches in the data can, and often do arise from measurement inconsistencies rather than malfeasance.44

Hopefully the word and checklist in a higher place tin help researchers ameliorate translate and choose between conflicting data sources.

Data Sources

International Historical Statistics (by Brian Mitchell)

- Data: Aggregate trade (current value), bilateral merchandise with master trading partners (electric current value), and major commodity exports by main exporting countries. No data on trade as share of Gdp is readily bachelor.

- Geographical coverage: Countries effectually the world

- Time span: Long time series with almanac observations – from 19th century up to today (2010)

- Available at: The books are published in three volumes covering more than 5000 pages.45

At some universities you lot can admission the online version of the books where information tables can exist downloaded as ePDFs and Excel files. The online access is here.

Penn Globe Tables

- Information: Real and PPP-adjusted GDP in The states millions of dollars, national accounts (household consumption, investment, government consumption, exports and imports), substitution rates and population figures.

- Geographical coverage: Countries around the earth

- Time bridge: from 1950-2017 (version 9.i)

- Available at: Online here

- Feenstra, Robert C., Robert Inklaar and Marcel P. Timmer (2015), "The Adjacent Generation of the Penn World Table" forthcoming American Economic Review, available for download at www.ggdc.net/pwt

Correlates of State of war Bilateral Merchandise

- Data: Total national trade and bilateral trade flows between states. Total imports and exports of each country in current US millions of dollars and bilateral flows in current US millions of dollars

- Geographical coverage: Unmarried countries around the earth

- Time bridge: from 1870-2009

- Available at: Online at www.correlatesofwar.org

- This information ready is hosted by Katherine Barbieri, Academy of South Carolina, and Omar Keshk, Ohio Country University. Authors notation in their 'Cow Trade Data Gear up Codebook': "Nosotros advise against using the dyadic data file to produce any national or global totals, based on aggregations of the partner trade."

World Banking company – Globe Development Indicators

- Data: Merchandise (% of GDP) and many more specific series: trade in trade, trade in services, trade in high-technology, trade in ICT goods, trade in ICT services – e'er exports and imports separately. Too consign and import value index and volume index.

- Geographical coverage: Countries and world regions

- Time bridge: Almanac since 1960

- Available at: Online at http://data.worldbank.org

Un Comtrade

- Data: Bilateral trade flows by commodity

- Geographical coverage: Countries around the earth

- Fourth dimension span: 1962-2013

- Available at: Online here

- Bilateral trade flows can be sorted past goods or services, monthly or annually, with choice of classification (including HS codes, SITC, and BEC). Information is likely to be very fourth dimension consuming to collate as there is no bulk data download unless a user has a premium site license.

UNCTADstat

- Data: Many dissimilar measures, including trade by volumes and value

- Geographical coverage: Countries around the globe

- Time span: For some series, data is available since 1948 – by and large almanac, sometimes quarterly.

- Available at: Online here

- UNCTADstat reports export and import information between 1995 and 2016 but primarily to different regional groupings than any ane country, so it's probably not all-time suited to comparison country-to-state bilateral flows.

Eurostat – COMEXT

- Data: Trade flows (also by commodity)

- Geographical coverage: Europe (EU and EFTA)

- Time bridge: Mostly since 1988

- Available at: Online here

- Too, the Eurostat website 'Statistics Explained' publishes up-to-date statistical information on international trade in goods and services.

World Trade Organization – WTO

- Data: Many series on tariffs and merchandise flows

- Geographical coverage: Countries around the world

- Time span: Since 1948 for some series

- Available at: Online here

- The WTO offers a majority download of merchandise datasets which tin be plant here. Amidst these are annual WTO merchandise trade values and WTO-UNCTAD-ITC almanac trade in services datasets. The old is available from 1948 – 2017, workable, with very little additional formatting needed. Even so, observations are country groups, such as the EU28, the BRICS etc. rather than country-by-country values. Otherwise, the WTO'south Statistics Database (SDB) has all-encompassing fourth dimension series on international merchandise, past country with their trading partners. Over again, trading partners are primarily restricted to state groupings rather than individual nations.

Fouquin and Hugot (CEPII 2016) – TRADHIST dataset

- Data: Many unlike data sets related to international trade, including merchandise flows by article geographical variables, and variables to estimate gravity models

- Geographical coverage: Countries around the world

- Available at: Online here

- TRADHIST Bilateral Merchandise Historical Series: New Dataset 1827-2014 provides all-encompassing dyadic trade data, with 97 percent of the observations from 1948 to today drawing on the IMF's Direction of Trade Statistics (DOTS) dataset.

NBER-United nations Merchandise Data, 1962-2000

- Information: Export and import values and volumes past article

- Geographical coverage: Unmarried countries

- Fourth dimension span: 1962-2000

- Available at: Online here

- This data is too available from the Center for International Data. Bilateral trade information value estimates are very close to that of the World Banking concern's imports of goods and services time series.

Federico-Tena World Trade Historical Database

- Data: This website contains almanac series of trade by polity from 1800 to 1938 which sum as series for continent and world.

- Geographical coverage: Countries around the world

- Fourth dimension span: 1800-1938

- Bachelor at: Federico, Thousand., Tena Junguito, A. (2016). World trade, 1800-1938: a new data-set. EHES Working Papers in Economic History, n. 93. Online hither

Other historical trade information sets

- Data on UK bilateral trade for the time 1870-1913 was nerveless by David Southward. Jacks. It is downloadable in excel format hither.

- For the time 1870-1913 21,000 bilateral trade observations can be constitute in Mitchener and Weidenmier (2008) – Trade and empire, available in the Economic Journal hither.

- Data on UK, Frg, France, and US betwixt mid-19th to 20th Century can be establish here.

- Data on Developing Country Consign – in 1840, 1860, 1880 and 1900 – by John Hanson is available here.

- Information ontrade between England and Africa during the flow 1699-1808 is available on the Dutch Data Archiving and Networked Services. It was compiled by Marion Johnson.

Source: https://ourworldindata.org/trade-and-globalization

Posted by: leverettfainizind.blogspot.com

0 Response to "How Has International Trade Changed Since Ww2"

Post a Comment